ExplainSpeaking: Ultra-rich individuals are projected to keep leaving India in 2023. Why do the rich migrate from a country?

India’s likely net outflow (net of inflow and outflow) in 2023 will make it the second worst performer on losing HNWIs after China. In 2022, India saw an outflow of 7,500 such individuals.

India has 3,44,600 HNWIs, 1,078 centi-millionaires (those with wealth exceeding $100 million) and 123 billionaires (those with wealth exceeding $1 billion or Rs 8,200 crore). (Express photo/Oinam Anand)

India has 3,44,600 HNWIs, 1,078 centi-millionaires (those with wealth exceeding $100 million) and 123 billionaires (those with wealth exceeding $1 billion or Rs 8,200 crore). (Express photo/Oinam Anand) Dear Readers,

According to the latest edition of the Henley Private Wealth Migration Report (2023), India is expected to witness a net outflow of 6,500 ultra-rich. The more technical term for these ultra rich is High Net-Worth Individuals (HNWIs) and it refers to people so rich that they have an investable wealth of US$1 million or more. In rupee terms that threshold means Rs 8.2 crore or more. Investible wealth refers to an individual’s net investable assets, namely, all their investable assets (property, cash and equities) minus any liabilities.

India’s likely net outflow (net of inflow and outflow) in 2023 will make it the second worst performer on losing HNWIs after China. In 2022, India saw an outflow of 7,500 such individuals.

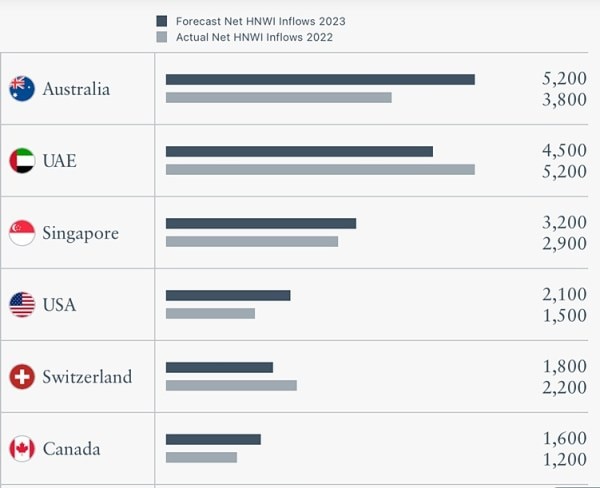

“The top five destinations for net inflows of high-net-worth individuals in 2023 are projected to be Australia, the UAE, Singapore, the USA, and Switzerland. On the flip side, the largest net outflows of millionaires are expected to come from China, India, the UK, Russia, and Brazil,” writes Andrew Amoils, the Head of Research at New World Wealth, the organisation that provides the data for this report (SEE CHARTS 1 and 2 for countries witnessing biggest net outflows and inflows).

Chart 2, on the biggest net outflows of high-net-worth individuals in 2023.

Chart 2, on the biggest net outflows of high-net-worth individuals in 2023.

Chart 2, on biggest net inflows of high-net-worth individuals in 2023.

Chart 2, on biggest net inflows of high-net-worth individuals in 2023.

To be sure, as of the end of 2022, India was among the 10 richest countries in the world — ranked 10th in the so-called W10 grouping — if one goes by the HNWI population. India has 3,44,600 HNWIs, 1,078 centi-millionaires (those with wealth exceeding $100 million) and 123 billionaires (those with wealth exceeding $1 billion or Rs 8,200 crore). India has a population of 1,428 million.

For comparison, China has 7,80,000 HNWIs and 285 billionaires while the US (with a population of just 340 million) has 52,70,000 HNWIs and 770 billionaires. The W10 includes (in order of HNWIs in each country) the US, Japan, China, Germany, the UK, Switzerland, Australia, Canada, France, and India.

Explaining what motivates the world’s wealthiest to migrate from one country to another, Juerg Steffen, CEO of Henley & Partners, writes:

“Affluent families are extremely mobile, and their transnational movements can provide an early warning signal in terms of a country’s economic outlook and future country trends. Like the proverbial canary in the coal mine, they alert us to dangers that may lie ahead as they are more sensitive to potential threats to their wealth and usually have the resources to take a corrective course of action to preserve their legacies. An increasing outflow of millionaires often points to a drop in confidence in a country, since high- and ultra-high-net-worth individuals have the means to leave and are usually the first to exit and vote with their feet when circumstances deteriorate.”

What are the top priorities of the wealthy?

Steffen writes that “political stability, low taxation, and personal freedom have always been key metrics for millionaires when it comes to deciding where to live. However, the priorities of affluent individuals are shifting to the intangible but equally vital elements that impact; their children’s prospects, the quality of their lives, and the legacies they leave.”

He points out that apart from being a safe haven for wealth, security is also a key factor, “which is why so much private wealth is flowing into countries that offer a robust regulatory environment where the rule of law is respected, and economic freedoms are guaranteed.”

Until tomorrow,

Udit